-

0+

years of experience

-

0+

employees

-

$ 0b

assets under management

-

0

countries

Assets in US dollars; all information as of September 30, 2023. LaSalle has recently adopted the agreed INREV, ANREV and NCREIF PREA joint industry definitions of Assets Under Management for Investment Managers in Real Estate.

Private equity

Portfolios of actively managed real estate available as fund or separate account solutions.

Private debt

Connecting real estate investors to capital borrowers.

Public equity

Actively managed portfolios of publicly traded real estate securities.

Indirect solutions

LaSalle’s Global Solutions platform allows investors to access a range of indirect opportunities including bespoke co-investments, joint ventures, fund-of-funds mandates, as well as a commingled fund which combines such capabilities.

Americas

Asia Pacific

Europe

Global

Core

Long-term investments designed to provide stable income with lower levels of risk.

Core plus

Investments designed to provide both income and capital growth with a low-to-moderate risk profile.

Value-add

Investments focused on capital growth that are typically held over a fixed time horizon with a higher-risk profile.

Open-ended funds

Commingled global and regional diversified, private equity investment strategies.

Closed-end funds

Commingled regional and sector-specific private equity and debt investment strategies with a set time horizon.

Individual transactions

Opportunities to invest with a limited number of partners.

Custom accounts

Bespoke accounts tailored to investor needs.

Alternative lending solutions

For those looking for capital to finance their real estate projects, LaSalle offers a variety of options for equity sponsors in the United States and Europe. We are a substantial non-bank lender in both markets and have been connecting borrowers with the capital they need in the US since 2006 and in Europe since 2010.

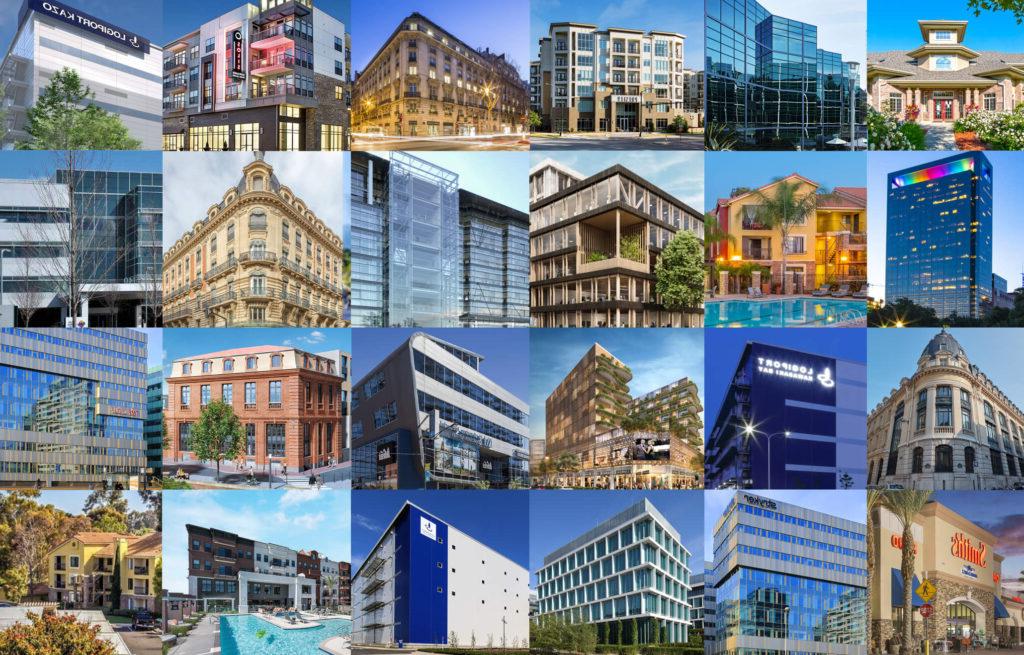

Asset Management at LaSalle

LaSalle’s Asset Management team is dedicated to enhancing the value of our clients’ assets. We work across all four major real estate sectors around the world: office, retail, residential and industrial/logistics. In addition, we also manage assets in emerging niche sectors, such as medical offices, long-term care facilities, leisure centers and hotels.